Taxation Annual Rates for 202021 Feasibility Expenditure and Remedial Matters Act 2021 2021 No 8. The scheme and purpose approach is as follows.

Ntn Tax Filer Pra Gst Chamber Tm Logo Reg Income Sales Tax Return E Filling Audit Notice Handling Tm Logo Tax Advisor Gulberg

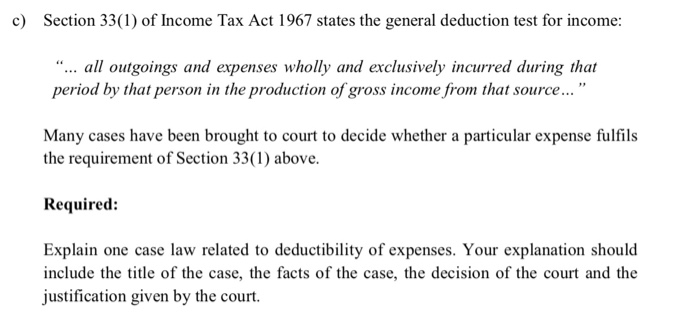

Interpretation of section 33.

. Classes of income on which tax is chargeable 4 A. In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the. Today we learn the provisions of section 1 of Income-tax Act 1961.

In short when you spend money to earn money youre allowed to deduct that cost from the income. The term this Act wherever occurring was substituted by sec. Chapter I Sections 1 to 3 of the Income Tax Act 1961 deals with the provisions related to preliminary.

This Act may be cited as the Income Tax Act1993. Recently we have discussed in detail section 139 Return of Income of IT Act 1961. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the.

Comptroller of Income Taxn Winslow J. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. 1 Reduce the total amount included in your assessable income under subsection 83A-25 1 for an income year by the total of the amounts included in your assessable income under that subsection for the income year for ESS interests to which all of the following provisions apply.

I consider whether an arrangement prima facie falls within any of the three threshold limbs of section 331 such that the taxpayer has derived a tax advantage. Generally you are only taxed for the profit that you or your business earns. Section 331 in The Income- Tax Act 1995 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall.

Reserve Bank of New Zealand Act 2021 2021 No 31. Involving the old section CEC. Special classes of income on which tax is chargeable 4 B.

Short title and commencement 2. Non-chargeability to tax in respect of offshore business activity 3 C. 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with.

Section 331 of the Income Tax Act 1967 ITA reads as follows. Amount of tax credit. 1 Short title 2 Interpretation.

As such theres no better time for a refresher course on how to lower your chargeable income. Section 33 in The Income- Tax Act 1995. Income Tax Act 2007.

Mining company or mining holding company liquidated Repealed Definitions. Held that the old section 33 was an annihilating section like section 260 of the Australia Income Tax Assessment Act 1936 and section 108 of the Land and Income Tax Act 1954 of New Zealand which was the prede cessor section to the current anti-avoidance provision. Net income Repealed CU 20.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that. Long Title Part 1 PRELIMINARY. Meaning of main maximum deposit.

2 of 1994. Income Tax Act 1947. Section 331 of the Income Tax Act 1967 ITA reads as follows.

Malaysias tax season is back with businesses preparing to file their income tax returns. Charge of income tax 3 A. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3.

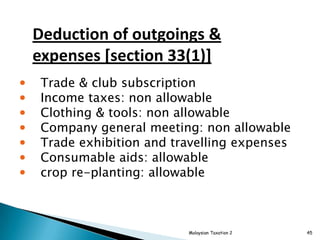

Section 300 1 Income Tax Crown Regional Holdings Limited Order 2021 LI 2021178 Taxation Budget 2021 and Remedial Measures Act 2021 2021 No 19. Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. A subsections 2 to 6 of this section.

Section 33 1 provides that for the purposes of determining tax a persons or business gross income shall be adjusted by deducting from that source all outgoings and expenses wholly and exclusively incurred in the production of gross income 1. Amendment of section 33. Industrial building means a building wholly or principally used for the purpose.

1 On the death of an employee in respect of whom a tax deduction card has been issued the employer shall send to the collector of taxes the certificate relating to cessation of employment and shall insert thereon the name and address of the personal representative of the deceased employee. Section 1 of IT Act 1961 provides for short title extent and commencement. Meaning of income from forestry.

In short when you spend money to earn money youre allowed to deduct that cost from the income. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. Income subject to tax means income subject to income tax under this Act other than under section 107 or 108.

Amount treated as repayment for purposes of section CU 17. 3 Appointment of Comptroller and other officers 3A Assignment of function or power to public body 4 Powers of Comptroller 5 Approved pension or provident fund or society 6 Official secrecy 7 Rules 8 Service and signature of notices etc. And if so ii consider whether the taxpayer may avail himself of the statutory exception.

Willing To Get Associated With A Performer

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Genesis Of The Indian Taxation System Small Business Tax Business Tax Tax Refund

Income Tax Deductions List Fy 2020 21 Save Tax For Ay 2021 22

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

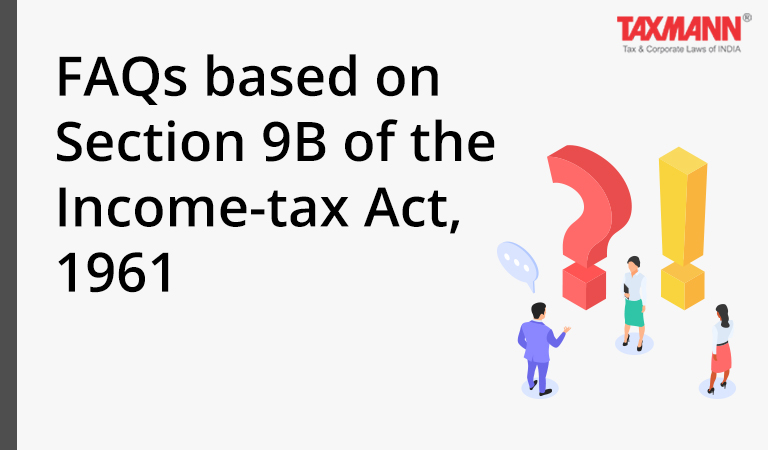

Faqs Based On Section 9b Of The Income Tax Act 1961

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

Assessments Under Income Tax Act 1961

Previous Year Under Income Tax Act 1961

1099 Nec Software To Create Print And E File Irs Form 1099 Nec

Chapter 5 Corporate Tax Stds 2

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Defination Of Persons Under Income Tax Act 1961

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax